As I’ve noted before in this space, the pet food segment continues to be robust despite the pandemic and the economic stresses it introduced. Part of the reason is the increase in sales of premium pet foods. Market analysts attribute the uptick in sales to more availability through broader distribution of these premium products, and they also say certain favorable demographic trends in the U.S. population are keeping demand strong. In fact, shifting age distributions are expected to keep the premium pet food market growing significantly through 2025, according to Sundale Research.

Empty Nesters

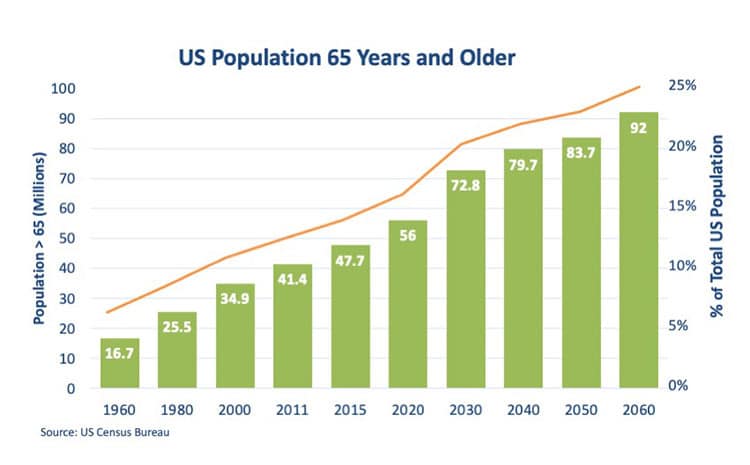

The graying of the American population is proving to be beneficial for premium pet food sales. Baby boomers and empty nesters are credited with keeping sales brisk in premium pet foods. There were more than 44 million Americans in the 55- to 64-year-old cohort in 2020. That figure is projected to top 49 million by 2025. This is the second fastest-growing age group in the U.S., with an average expected growth rate of 2% per year through 2025. The fastest growing population segment, though, is 65 and up, which is estimated to increase from 57 million in 2020 to 65 million in 2025. That puts the annual average growth rate at 2.6% for the segment.

In empty nest/boomer households, pets have replaced children. As a consequence, these pet parents now lavish their attention and resources on pampering their pets with premium pet foods. It also doesn’t hurt that older boomers are reaching an age (72) where they have to start drawing down from retirement accounts. This gives them more disposable income to splurge on their furry charges. The splurging goes beyond just treating pets with tasty morsels. Boomers want their pets to have the best food available for them. Foods not only need to be good tasting, but they must be nutritious and support their pets’ well-being. As boomers have become more aware of the food – health connection in relation to their own diets, they’re applying this same knowledge into selecting food for their beloved pets.

Testing the nest

Analysts at Sundale Research posit that while boomers and empty nesters may be driving premium pet food sales at the moment, they’re being outspent in total pet industry purchases by young professionals. At the younger end of the age spectrum, millennials and the most senior of Gen Z are buying more upscale pet products. For this younger cohort who are putting off children of their own for now, pets are filling the void. Young professionals are spoiling their pets as if they were children not only with food but with all types of accessories and services.

These younger generation pet owners – millennials, Gen Z, and Gen X (though smaller) – will be the primary force moving pet food sales in the future. More than any previous generations, millennials and Gen Z have always thought of their pets as part of their family, and therefore have a strong connection with them. Unlike older consumers, younger pet parents are more digitally savvy, engaging online to research, buy and rate products. They’re also interested in participating in new product development via social media. On the other hand, they are less brand loyal, want more transparency on product labels, and put more value on a product’s sustainability than older consumers.

Notably, millennials and Gen Z are more ethnically diverse than previous generations. Today’s ethnic minorities will be the majority in the U.S. by mid-century with Hispanics projected to become the largest of them. Currently Hispanics demonstrate below average pet ownership, but this may change as they have children. (Having children in a household increases pet ownership.) Cultivating younger more ethnically diverse pet parents will fuel future premium pet food sales.

So, what’s attracting consumers to premium and functional pet foods? The promise of better ingredients that will keep pets happy and healthy. Whether appealing to empty nesters, baby boomer or newly established Gen Z pet parents, premium pet food brands are tempting them with a dizzying array of products featuring specialized ingredients.

- Human-grade

- Wholesome

- Functional

- Easy-to-understand

- Natural

- Organic

- No additives or preservatives

- Clean label

- Transparent origins and sources

- Traceability and sustainability

If you’re looking for label-friendly ingredients to attract premium pet food buyers, look no further than our Tree Top fruit ingredients.

And did you hear about our new Dried Pumpkin Flake Powder? Contact us.