IRI midyear sales figures and market insights

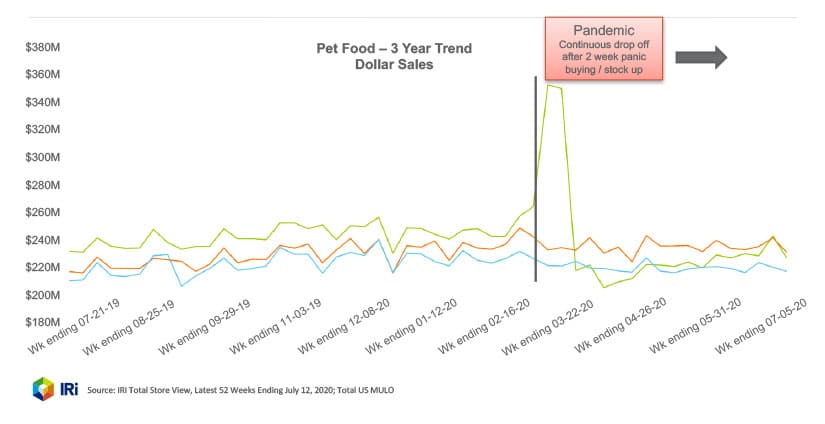

As you’d expect in this year like no other in our collective memory, sales in pet foods have been erratic. The year started off on a positive note with year-over-year sales steadily beating 2019 numbers through Feb., according to IRI data. Then March hit and a two-week period of panic buying set in or some serious stocking up took place. And with that, sales spiked about $100 million above previous levels. After that, pet food sales sank below historic market expectations as pet parents used food they had on hand.

A look at IRI’s mid-July figures does show a slight recovery in pet food sales, though. Growth was primarily due to dry dog food, and wet dog and cat food sales. Branded pet foods fared better than private label. Private label sales were down prior to the onset of COVID, and unfortunately, the pandemic didn’t change that trajectory.

Despite the volatility in overall pet food sales since the first of the year, projections for the segment are positive. Mintel is forecasting pet food sales to reach $31.6 billion by 2024 – which is a 13% increase from 2019.

Market Insights

Two top trends IRI identified as influencing pet food sales:

- Super premium brands – growing in mass channels (e.g., Blue Buffalo dry dog food increased its distribution in mass and club retailers and saw a large sales increase)

- Meal subscription services – more pet owners are using these (OK, here’s my editorial comment – WOW! I’m not surprised these services exist, but I am a little surprised by their number and popularity. As you might expect, it’s not inexpensive to get freshly made meals using human-grade ingredients for your pet delivered to your door. What is great is some of these services will customize recipes for picky pets or those on restricted diets. For pet owners who are making their own pet food, this is another option.)

Purchase influences

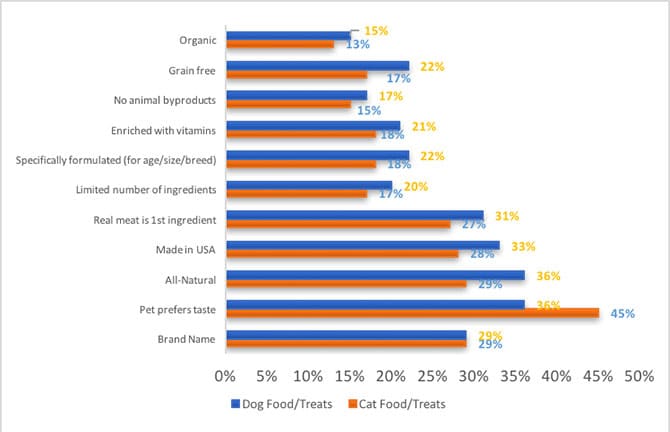

More from IRI, here are some of the determinants that impact pet food buying decisions:

- Taste – interestingly, taste is mainly a preference priority for cat food purchases

- Natural/Organic foods – this is a preference found more commonly among younger pet owners rather than older ones. Interestingly, younger people are also more likely to choose natural and organic foods for themselves than their older cohorts.

- Again, following their own dietary preferences, younger pet owners are also more likely to buy premium pet food brands with real meat as the first ingredient, no animal byproducts, grain free, and with a limited number of ingredients.

Pet food/treats: Why owners buy

Factors with the greatest influence on purchase decisions:

Pet food/treats: What owners want

Pet parents were asked what they’d like to see more of in pet food and treats.

- 47% treats with added nutrition

- 46% natural meat treats

- 22% sustainably-sourced pet food

- 18% pet food with plant-based protein

- 16% freshly, prepared refrigerated food

- 12% freeze dried or dehydrated raw food

Nearly half of respondents wanted to see treats that provide their pets with added nutrition. So, in other words, they want treats with benefits whether that be cognitive, joint health or skin and coat.

The Tree Top Advantage

Consider fruit-based treats or adding fruit to your pet food formulas. Tree Top fruit ingredients are grown in the U.S., all natural, available organic, grain free and contain no animal byproducts. And we have a number of formulations that would lend themselves well to nutritional fortification beyond their naturally nutritious fruit profile. Let’s talk.