Based on the most recent numbers from the Washington State Tree Fruit Association, published December 1, 2021, the Washington apple crop is down 3.9% from the August estimate. The 2021 U.S. apple harvest overall is down 5.7%, and it is off 9.4% from the five-year average.

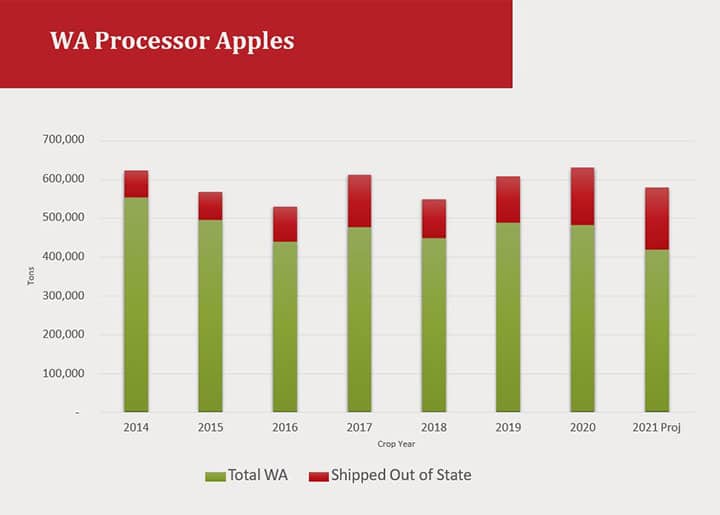

The largest impact to the Washington processor crop is the fact that Michigan is down 17%, New York is down 9%, and California is down 32%. These three states along with Canada are large buyers of processing fruit from Washington State. With the reduced crop in their local regions, this heightened competitive demand for Washington fruit has not been seen since the 2012 crop.

Graph 1.0

From June to December 1st, conventional juice per ton prices increased 84%. Peeler prices are up 48% while organic juice rose 60% and organic peelers 61%. Currently with demand exceeding supply, there is no indication of this trend slowing down. In general, across the supply chain, price increases are close to historical highs. In fact, CPI in June of 2019 was 1.8; today it is 6.3. This is the largest inflation surge in more than 30 years.

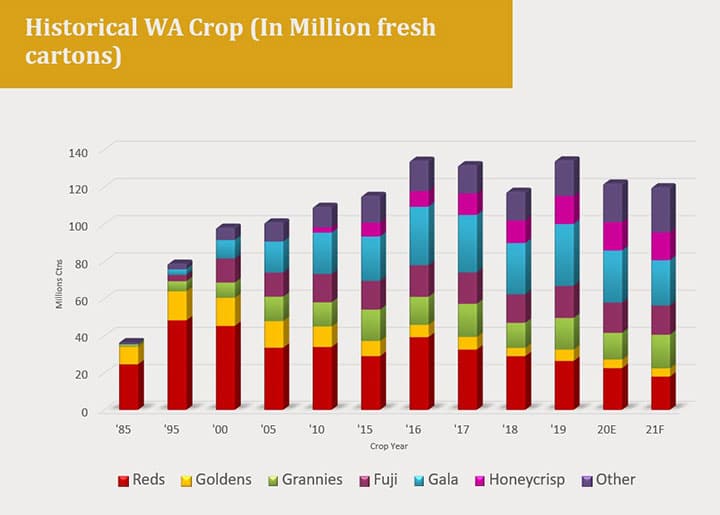

At the apple varietal level, as shown in graph 1.1 below, Gala retains the top spot. Over the last five years, Gala, Fuji, and Honeycrisp have been on the rise largely at the expense of Red Delicious.

Graph 1.1

Outlook: Realistically there should be enough processing fruit to satisfy the demand for Washington in-state processors, as well as for those that buy Washington fruit for other states. The crop in Washington is down 4% from the 5-year average, it is not catastrophically short. Pack-outs of fresh cartons while thus far have been average to good, the triple digit heat Washington had in July will likely affect some varieties once they come out of storage, reducing the amount of fresh cartons from each bin of fruit.